Find the correct commodity code in the Customs Tariff

To classify goods in the Customs Tariff means to find a commodity code. Once you have found the correct commodity code you will find, among other things, the duty rate and if any prohibitions and restrictions may apply for your item.

If you intend to import goods for private use, you may use our import calculator to find out what you have to pay.

What is the Customs Tariff?

The Customs Tariff is a Norwegian regulation which contains commodity codes and commodity descriptions. It is based on the Harmonized Commodity Description and Coding System (HS), which is used by most countries in the world.

The Customs Tariff consists of 97 chapters and starts with live animals in chapter 1 and ends up with antiques in chapter 97. You will find commodity codes in the Customs Tariff for all goods. It is only availible on our website and you will find information on both customs duty and excise fees (if any) to each commodity code.

What is a commodity code?

A commodity code is made up of eight digits, the first six of which are international. This means that the first six digits in a commodity code on a foreign invoice in principle should be identical to the first six digits of the Norwegian Customs Tariff.

The first four digits is called a heading number. The associated text is called the heading text. The next two digits, together with the first four, identifies a six-digit subheading. All eight digits together is a commodity code.

Example of a commodity code:

61.09.1000 – T-shirts of cotton

Why is it important to have the right commodity code?

The correct commodity code will provide you with the correct customs duty and tax information. It will also give an indication if the item is restricted or banned on importation into Norway.

If the Norwegian Customs carries out a tax audit and find that you have not declared the item using the correct commodity code and have paid too little duty, you will be retrospectively charged an additional amount to cover the difference. In addition, you may also be charges with a violation fine.

Using the right commodity code also means that the official trade statistics will be as accurate as possible, this also benefits the industry.

How do I find the correct commodity code?

First, you need to know exactly what you will be importing or exporting. Some products, particularly foodstuff, can be put together in complex ways. It is therefore important that you have a list specifying the contents as percentages. Incorrect or lacking information may lead to an incorrect commodity code.

Start by finding the correct heading number. When you have found the correct heading number for your item, the next step is as follows:

First you see what is reffered to as one dash subheadings. Read all the one dash subheadings, and click on the text that describes your item directly or best.

A colon after the text means that there are several subdivisions. Click on the text, and they will appear.

Example

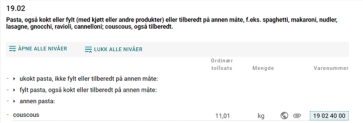

You are importing uncooked pasta stuffed with, by weight, less than 20 % meat. Heading 19.02 looks like this:

As you can see, pasta is mentioned several places in the heading. To find the right commodity code, you therefore need to know what kind of pasta you are importing.

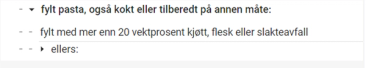

The pasta in this example is uncooked, stuffed with less than 20 % meat. It is therefore best described as "stuffed pasta, whether or not cooked or otherwise prepared". When you click on this text you will se that this subheading has two subdivisions:

The pasta in this example is not stuffed with more than 20% meat or meat offals. It is "Other" that gives the best description of these two texts. We now have two choises, "Cooked" or "Other":

The correct commodity code for our example is 19.02.2099. You may click on this line, and you will find information on duty rates, VAT and restrictions, if any.

The globe-symbol indicates that the commodity number is covered by one or more free trade agreements. The paper clip-symbol indicates that there is more information regarding the commodity number.

It can sometimes be difficult to find the right commodity code. You are welcome to contact us.

Verbal advice is not a binding decision. If you are looking for predictability regarding your item`s commodity code in the Customs Tariff, you can apply for a binding tariff information for the item you wish to import/export. This service is free of charge.

Updated: 09/01/2025